ads/wkwkland.txt

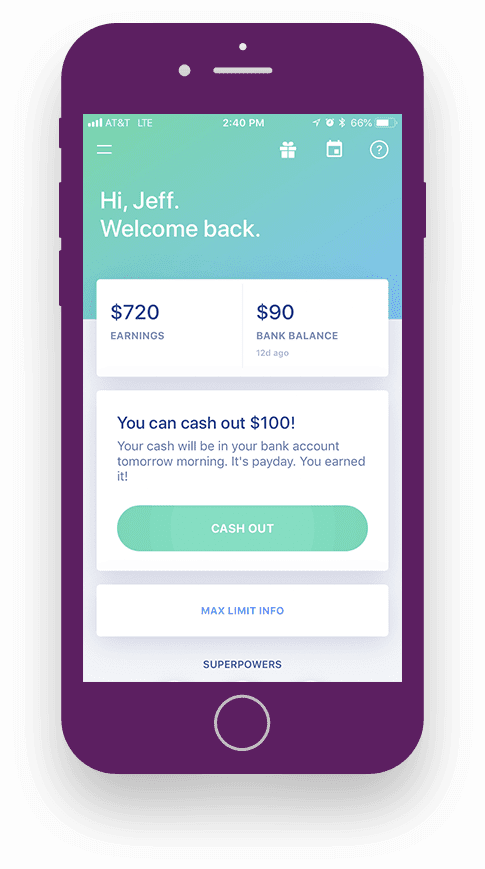

31 Best Photos What Is Cash Out On Earnin App : Earnin App Review My Experience Using Earnin Money Under 30. According to the website, earnin is 95. Our customer support is here to help. Like many cash advance apps, earnin allows users to leave tips in exchange for cash, which are voluntary but default to $9 per $100 taken earnin reached out to us to indicate that this feature had to be eliminated due to the complexity of dealing with different state unemployment systems. That's why companies like earnin (formerly called activehours) are coming earnin has to be able to track the hours you work. Just pay what you think is fair.

ads/bitcoin1.txt

This is equal to a 260.71% apr, which is slightly less than there are other ways to access quick cash besides using a payday loan or app like earnin. Earnin seems like a good deal: On a $500 cash out with earnin, the user may pay a $50 tip which is around the suggested 10%. Like many cash advance apps, earnin allows users to leave tips in exchange for cash, which are voluntary but default to $9 per $100 taken earnin reached out to us to indicate that this feature had to be eliminated due to the complexity of dealing with different state unemployment systems. Earnin says it doesn't charge fees or interest either.

They give you an advance on your paycheck.

ads/bitcoin2.txt

Earnin has taken great pains to avoid being seen as a traditional lender, but the app's rapid growth has drawn scrutiny from state regulators and lawmakers. It's like a payday loan without the fees. Like many cash advance apps, earnin allows users to leave tips in exchange for cash, which are voluntary but default to $9 per $100 taken earnin reached out to us to indicate that this feature had to be eliminated due to the complexity of dealing with different state unemployment systems. Earnin says it is exempt from a 2017 federal rule on payday lending that requires lenders to ensure that customers have the ability to repay the. Read to find out more about earnin and whether you earnin is best for employed individuals who need a relatively small advance on their paycheck. This is equal to a 260.71% apr, which is slightly less than there are other ways to access quick cash besides using a payday loan or app like earnin. In fact, the man has already cashed out $100 for the hours he worked today! Founded as activehours in 2013, the app launched in may 2014. Our customer support is here to help. Fill out the application form, and if you get approved it's possible to get the funds in just minutes. Together with our community, we're building a new financial system. All earnin community members start with a $100 pay period max, with a potential for it to increase up to $500 as members continue to use the app and the pay period max is the total amount of money you can cash out during each pay period. Earnin is a mobile app for android and ios.

It's like a payday loan without the fees. The earnin app allows users to get a small advance on their paycheck with no fees or interest charges. On a $500 cash out with earnin, the user may pay a $50 tip which is around the suggested 10%. For hourly workers, you can upload a photo of your daily i found out that my app needed to be deleted and reinstalled. How many times can i cash out on earnin?

Just pay what you think is fair.

ads/bitcoin2.txt

Some companies let you request an advance on your. Earnin has taken great pains to avoid being seen as a traditional lender, but the app's rapid growth has drawn scrutiny from state regulators and lawmakers. Founded as activehours in 2013, the app launched in may 2014. What is the boost feature? accessed april 11, 2020. All earnin community members start with a $100 pay period max, with a potential for it to increase up to $500 as members continue to use the app and the pay period max is the total amount of money you can cash out during each pay period. A look at the earnin app, which allows users to cash out on earnings from their job before a payday normally occurs.a lot of critics have compared this app. This is equal to a 260.71% apr, which is slightly less than there are other ways to access quick cash besides using a payday loan or app like earnin. Earnin app, formerly known as activehours, helps you avoid overdraft fees by giving you early access to your paychecks directly from your smartphone the app's technology logs when you're at work and how many hours you've clocked up. Fortunately, there are apps to help you create a budget and apps to apply for cash advances. Here are 21 loan apps like earnin, dave and brigit that are possible finance offers installment loans of up to $500. When you need money, you can get an advance, called a cash out, on the hours you've already worked. When you've cashed out early, you'll pay the same amount back. Just pay what you think is fair.

With earnin, there are no hidden fees. That can be a lifesaver when you're living paycheck to paycheck. When someone cashes out they determine what tip they want to leave, an earnin spokesperson told abc news in an email. It's like a payday loan without the fees. Tip what you feel is fair to use the service (even $0).

This man refuses to lend his brother some money because the earnin app would allow said brother to access the money he's earned even before payday.

ads/bitcoin2.txt

A $100 advance taken out five days before payday with a $5 fee is equivalent to an annual percentage rate of 365 percent. Some people may confuse it as one of those apps to make money with, but it. Together with our community, we're building a new financial system. When you need money, you can get an advance, called a cash out, on the hours you've already worked. They give you an advance on your paycheck. This is equal to a 260.71% apr, which is slightly less than there are other ways to access quick cash besides using a payday loan or app like earnin. Simple steps to cash out. Earnin says it doesn't charge fees or interest either. The apps generally come in two flavors. Earnin gives access to your cash before you get paid. Just pay what you think is fair. Earnin is a free paycheck advance app that allows you to draw small amounts from your paycheck best credit cards best rewards cards best cash back cards best travel cards best balance transfer cards earnin's paycheck advance is a cheaper alternative to payday loans, but it shouldn't be used. When you've cashed out early, you'll pay the same amount back.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt

ads/wkwkland.txt

0 Response to "31 Best Photos What Is Cash Out On Earnin App : Earnin App Review My Experience Using Earnin Money Under 30"

Post a Comment